Customer reporting

Country-specific tax reporting is playing an increasingly important role in the cross-border services offered by banks. Tax honesty and client transparency are the main driving factors here.

A financial institution that wants to stand out from the competition must offer its clients detailed and attractive tax reporting.

The SECTRAS component "German Tax Reporting" fully covers both domestic and foreign customer-specific tax reporting as well as reporting to the German authorities responsible for tax matters.

In addition to the tax assessment and the resulting tax calculation, if applicable, documentation of all tax-related processes based on legal requirements and customer-specific concerns is necessary.

SECTRAS fully covers both client-specific reporting and reporting to the German authorities responsible for tax matters.

International political developments on tax honesty are forcing banks to increase the quality of their customer service and reporting and thus also the tax honesty of their customers.

The thereby increasing requirements for annual tax reporting for foreign clients pose new challenges for all national and international banks.

SECTRAS also offers credit institutions not based in Germany the possibility of high-quality service reporting for their foreign customers.

At present, it can be assumed that investors with foreign currency accounts often unknowingly file incomplete tax returns to settle their securities transactions.

Use SECTRAS for the tax processing of foreign currency and forward exchange transactions as well as transactions in cryptocurrencies such as BITCOIN, ETHER & Co. SECTRAS manages the FiFO stock and generates transparent and detailed §23 tax reporting for your clients.

Reporting

Constantly tightening regulatory standards force financial institutions to permanently deal with compliance with a wide range of reporting regulations.

In addition to communication with different supervisory authorities (Federal Financial Supervisory Authority and Federal Central Tax Office), different reporting periods must also be taken into account.

Pursuant to Section 24c (1) of the German Banking Act (KWG), financial institutions are obliged to maintain a data pool in which specified customer and account master data (e.g. account number, name and date of birth of account holders and authorised signatories, opening and closing dates) are stored.

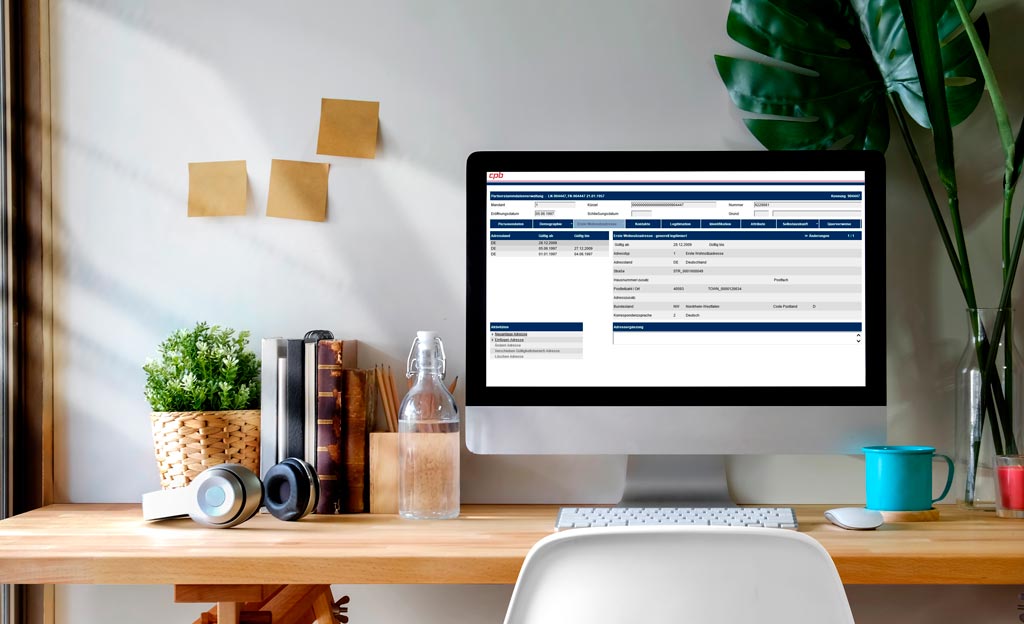

In SECTRAS, a component is available that prepares the relevant data from the central master data systems in accordance with the legal requirements and forwards it to the Bank-Verlag's account records centre.

CPB takes over the hosting, the complete conversion (conversion) into the prescribed reporting format, the legal storage and the communication with the account records centre.

A standardised solution for FATCA, CRS and future requirements

Whether US FATCA, UK FATCA, the EU Mutual Assistance Directive or the OECD Common Reporting Standard - as a result of international efforts to promote tax honesty, the Automatic Exchange of Information in Tax Matters (AEOI/AIA) is gaining acceptance as a global solution.

With CRS.SUITE, CPB has developed a standardized and flexible solution for compliance with the reporting obligation.

The CPB ERiC client is our software solution for the technical transmission of ELSTER reports to the data centres of the German tax authorities. This includes a procedure-compliant technical validation, enrichment as well as signature, encryption and decryption of the transmission data.

The ELSTER client software enables a tax application software, financial or payroll accounting software to file the tax return or tax return electronically.