Überblick

Gemeinsam gestalten wir Lösungen! Übernimm auch du pro-aktiv Verantwortung. Unser erfahrenes und gut eingespieltes Team wird dich auf deinem Weg laufend unterstützen! Bewirb dich jetzt und werde Teil der CPB!

Wir bieten flexible & passgenaue Lösungen – Egal ob Best-of-Breed oder Komplettlösung, bei uns finden Kunden immer die passende Lösung!

Wir bieten individuelle Softwarelösungen auf Basis modernster Technologien und offener Standards.

Sie konzentrieren sich auf Ihre Kernkompetenz - wir managen Ihre IT und Geschäftsprozesse.

Als Full-Service-Provider steht die eigentümergeführte CPB SOFTWARE AG für maximalen Service aus einer Hand. Die damit verbundene Position als Spezialist für IT-Gesamtlösungen unterstreichen wir mit 25 Jahren an Erfahrung und aktuell mehr als 600 aktiver zufriedener Kunden in Österreich, Deutschland und weiteren 14 Ländern.

Erfahren Sie mehr über die CPB Community, eine vielfältige und innovative Gemeinschaft von Kunden, Forschungsgruppen, Fintech und Partnern. Sie sind bereits Kunde? Dann nutzen Sie unbedingt unseren Infopoint und das SupportNet.

Gemeinsam gestalten wir Lösungen! Übernimm auch du pro-aktiv Verantwortung. Unser erfahrenes und gut eingespieltes Team wird dich auf deinem Weg laufend unterstützen! Bewirb dich jetzt und werde Teil der CPB!

End-to-End-Prozess für die Abwicklung der Deutschen Abgeltungsteuer: Von der Steuerkalkulation, über das Meldewesen, bis zur Herstellung des komplexen On- bzw. Off-Shore Kundenreportings bzw. des OECD Common Reporting Standards.

Niedrigzinsphase, Digitalisierung, erhöhter Wettbewerb und Regulatorik – Banken befinden sich in einer Phase des Umbruchs.

Wer mit der Zeit gehen will, der muss sich dabei regelmäßig neu erfinden.

Insbesondere der erhöhte Kostendruck wirkt sich auf die Erweiterung des Kerngeschäftes und auf die Optimierung der bestehenden Bankprozesse aus. Flexibilität und schnelle Reaktionszeit sind dabei essentiell, um auf Innovationen und regulatorische Anforderungen am Markt reagieren zu können.

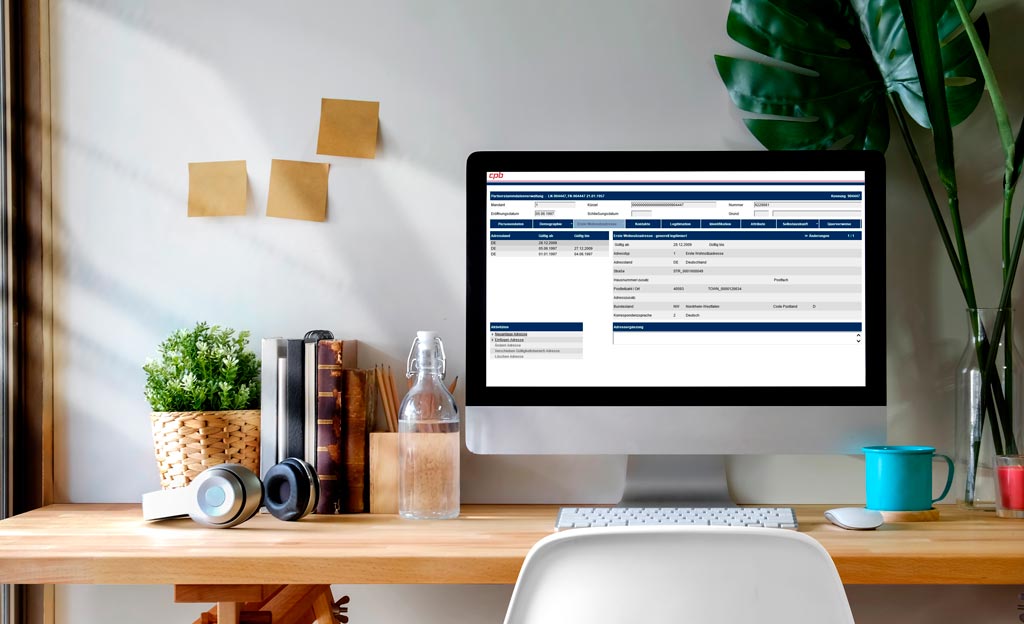

Modularität, Skalierbarkeit und die Verwendung moderner Entwicklungsmethoden machen SECTRAS zu einem der effektivsten Systeme am Markt, welches sowohl On-Premise, als auch im Service betrieben werden kann.

Das länderspezifische Steuerreporting spielt im grenzüberschreitenden Dienstleistungsangebot der Banken eine immer wichtigere Rolle. Steuerehrlichkeit und Kundentransparenz sind dabei die wesentlichen treibenden Faktoren.

Wer sich als Finanzinstitut von den Mitbewerbern hervorheben möchte bietet seinen Kunden ein detailliertes und ansprechendes Steuerreporting.

Die SECTRAS-Komponente „German Tax Reporting“ deckt sowohl das in- und ausländische kundenspezifische Steuerreporting als auch die Berichterstattung an die für steuerrechtliche Belange zuständigen deutschen Behörden vollständig ab.

Neben der steuerlichen Würdigung und der sich daraus gegebenenfalls ergebenen Steuerkalkulation ist eine auf gesetzlichen Anforderungen basierte und kundenspezifische Belange ausgerichtete Dokumentation aller steuerlich anfallenden Vorgänge notwendig.

SECTRAS deckt sowohl das kundenspezifische Reporting als auch die Berichtserstattung an die für steuerrechtliche Belange zuständigen deutschen Behörden vollständig ab.

Internationale politische Entwicklungen zur Steuerehrlichkeit zwingen Banken die Qualität ihres Kundenservice und –reportings und somit auch die Steuerehrlichkeit ihrer Kunden zu erhöhen.

Die dabei steigenden Anforderungen an das jährliche Steuerreporting für ausländische Kunden stellen alle nationalen und internationalen Banken vor neue Herausforderungen.

SECTRAS bietet auch nicht in Deutschland ansässigen Kreditinstituten die Möglichkeit eines qualitativ hochwertigen Service-Reportings für ihre ausländischen Kunden.

Derzeit ist davon auszugehen, dass Anleger mit Fremdwährungskonten zur Abwicklung ihrer Wertpapiertransaktionen häufig unbewusst unvollständige Steuererklärungen abgeben.

Nutzen Sie SECTRAS für die steuerrechtliche Abwicklung von Fremdwährungs- und Devisentermingeschäften sowie Transaktionen in Kryptowährungen wie BITCOIN, ETHER & Co. SECTRAS verwaltet den FiFO-Stock und erzeugt für Ihre Kunden ein transparentes und detailliertes §23-Steuerreporting.

Sich ständig verschärfende aufsichtsrechtliche Normen zwingen die Finanzinstitute, sich permanent mit der Einhaltung von vielfältigen Meldevorschriften auseinander zu setzen.

Neben der Kommunikation mit unterschiedlichen Aufsichtsbehörden (Bundesanstalt für Finanzdienstleistungsaufsicht und Bundeszentralamt für Steuern) sind darüber hinaus auch differierende Meldeperioden zu berücksichtigen.

Finanzinstitute sind nach § 24c Abs. 1 KWG verpflichtet, einen Datenpool zu führen, in dem festgelegte Kunden- und Kontostammdaten (z.B. Kontonummer, Name und Geburtsdatum der Kontoinhaber und Verfügungsberechtigten, Eröffnungs- und Schließungsdatum) gespeichert sind.

In SECTRAS steht eine Komponente zur Verfügung, die die relevanten Daten aus den zentralen Stammdatensystemen entsprechend der gesetzlichen Vorgaben aufbereitet und an die Kontoevidenzzentrale des Bank-Verlag weiterleitet.

CPB übernimmt das Hosting, die vollständige Umsetzung (Konvertierung) in das vorgeschriebene Meldeformat, die gesetzliche Aufbewahrung und die Kommunikation mit der Kontenevidenzzentrale.

Eine standardisierte Lösung für FATCA, CRS und zukünftige Anforderungen

Egal ob US-FATCA, UK FATCA, EU-Amtshilferichtlinie oder aber der OECD Common Reporting Standard – als Ergebnis der internationalen Bestrebungen zur Förderung der Steuerehrlichkeit setzt sich der Automatische Informationsaustausch in Steuersachen (AEOI/AIA) als globale Lösung durch.

Mit der CRS.SUITE hat CPB eine standardisierte und flexible Lösung zur Einhaltung der Meldepflicht entwickelt.

Der CPB ERiC-Client ist unsere Softwarelösung für die technische Übermittlung der ELSTER-Meldungen an die Rechenzentren der deutschen Finanzbehörden. Dieser beinhaltet eine verfahrenskonforme technische Validierung, Anreicherung sowie Signatur, Ver- und Entschlüsselung der Übertragungsdaten.

Die ELSTER-Clientsoftware ermöglicht einer Steueranwendungssoftware, Finanz- oder Lohnbuchhaltungssoftware die Steuererklärung oder Steueranmeldung elektronisch abzugeben.

Individuell passende Dienstleistungen im richtigen Moment. Sie definieren individuell Ihr Leistungsspektrum und stellen sich dadurch Ihr persönliches Dienstleistungspaket zusammen. Neben einer modularen Einsetzbarkeit ist die vollumfängliche Verarbeitung zur Deutschen Abgeltungsteuer auch einfach in Ihre Systemlandschaft zu integrieren.

Ein hoher Automatisierungsgrad in der Erstellung und die Möglichkeit von retrograden Korrekturen runden das optimale Gesamtpaket für Banken ab.

Eine der Grundlagen für eine qualitativ hochwertige und revisionssichere Verarbeitung stellen die von WM Datenservice publizierten Daten dar. Die prozessbezogene Integration einer Realtime-Anbindung von WM-Daten garantiert dabei die Korrektheit und Nachvollziehbarkeit der steuerlichen Würdigung – von der Transaktionsverarbeitung, über Corporate Actions bis hin zum Meldewesen & Steuerreporting.

Eine Implementierung von SECTRAS kann in überraschend kurzer Zeit erfolgen. Spezielle Teams agieren hierbei mit viel Routine und Migrationserfahrung. Die Integration bestehender Lösungen sowie Schnittstellen in andere Systeme einer Bank sind dabei Bestandteil des Projektes. Die Durchlaufzeit entsprechender Projekte liegt zwischen 3 und 6 Monaten.

Die Regelungen des ISAE 3402 zielen darauf ab, das interne Kontrollsystem einer Dienstleistungsorganisation zu prüfen und das Prüfergebnis Abschlussprüfern von Unternehmen zur Verfügung zu stellen, die die Dienstleistungsgesellschaft mit der entsprechenden Dienstleistung beauftragt haben.

"Als Privatbank für alle ist die Sutor Bank Partner von digitalen Unternehmen. Dabei erfordert die technische Anbindung vielseitiger Finanz-Dienstleistungen sichere und passgenaue Schnittstellen. Für die System-übergreifende steuerliche Würdigung der Sutor Kunden setzen wir auf die Steuersuite SECTRAS aus dem Lösungsportfolio der CPB. Danke für die kompetente, zielorientierte und partnerschaftliche Zusammenarbeit."

Lorenz Lorenzen, Leiter Anwendungsentwicklung und Datenschutzbeauftragter der Sutor Bank

Nutzen Sie unsere professionelle Infrastruktur mit höchsten Sicherheitsstandards – wir ermöglichen Ihnen den Aufbau einer Infrastruktur für eine Cloud-basierte Technologie und stellen Ihnen gerne Ressourcen wie virtuelle Maschinen, Netzwerkverbindungen, Speicherplatz und Rechenleistung aus der CPB Cloud zur Verfügung.

Wir übernehmen den Betrieb von geschäftsrelevanten Applikationen und stellen diese im CPB Rechenzentrum für die Nutzung bereit. Außerdem sorgen wir für automatische Updates der Software – Sie müssen sich keine Gedanken über die Beschaffung neuer Releases oder Patches machen.

Ihre Kernkompetenz liegt in der Beratung, Vertrieb oder Produktion – unsere im effizienten Abwickeln der dahinter notwendigen Prozesse. Wie schon von vielen Kunden erfolgreich in Anspruch genommen: Wir stellen Ihnen die erforderlichen IT-Ressourcen zur Verfügung und übernehmen zusätzlich komplette Backoffice-Prozesse.

Noch Fragen?

Ich beantworte sie gerne!

Copyright 2023 – CPB SOFTWARE AG

Noch Fragen?

Ich beantworte

sie gerne!

Sergio do Adro

Head of Customer Services

Telefonnummer: +49 (9371) 9786-77